Ever wonder how a single missing code on a medical bill could delay reimbursement for months, can result in a financial bind for healthcare providers? In California’s workers’ compensation system, precision in billing is non-negotiable to ensure timely payments and maintain care delivery for injured workers.

The California Division of Workers’ Compensation (DWC) has established detailed guidelines for medical billing and payment. These rules follow federal Health Insurance Portability and Accountability Act (HIPAA) standards and align with workers’ compensation under California Labor Code §4603.4. According to Labor Code §4603.4, it is mandatory for claim administrators, payers, or third-party administrators to accept electronic claim submissions. While healthcare providers can choose between electronic or paper submission. Per Title 8, California Code of Regulations §9792.5.1, the system aims to reduce disputes, which impact 15-20% of bills due to errors, according to DWC data.

In this blog, we explore the key steps, formats, roles, and best practices for navigating this process effectively.

Guidelines for WC Medical Billing and Payment:

1. Preparing and Submitting a Complete Bill:

The billing process begins with compiling a complete bill, a critical step to avoid rejections. The DWC’s Medical Billing and Payment Guide defines that a complete bill should include the injured employee’s identification (Social Security Number or default 999999999 if unavailable), date of injury, claim number (if known), and itemized service codes aligned with the Official Medical Fee Schedule (OMFS). Unpaid bills trigger a mandatory critique on Evaluation of Review (EOR) in 15 work days, pointing out the shortages. It also mentions that up to 25% of bills are rejected for missing elements like supporting documentation, such as operative reports or jurisdictional forms.

Essential Bill Components in workers’ comp billing:

The key components are as follows:

1. Injured employee’s details (SSN, date of birth, date of injury).

2. Service details with ICD diagnosis and procedure codes.

3. Provider’s National Provider Identifier (NPI) or state license number.

4. Properly annotated attachments in the PWK segment for electronic submissions.

Managing all this can be a difficult task, along with keeping up with daily clinical routines. Therefore, providers commonly outsource to medical billing and coding companies to ensure accuracy, as errors in these elements lead to delays or denials.

2. Billing Formats: Electronic and Paper Options:

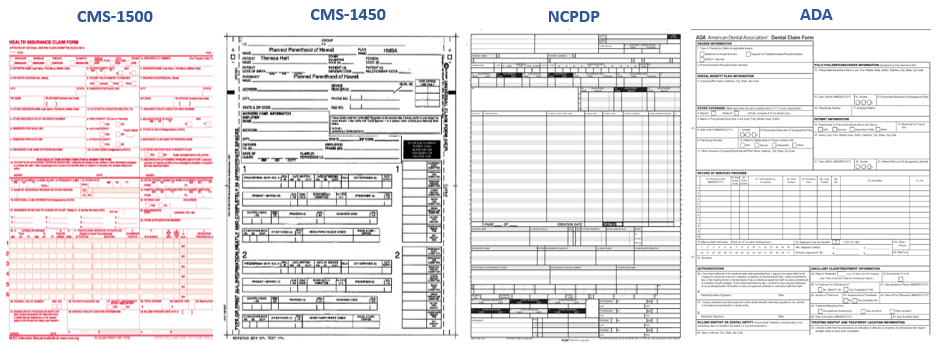

The California Division of Workers’ Compensation (DWC) has 4 different billing format standards, each with a different purpose. These forms can be submitted electronically or on paper.

Figure 1different billing forms

i. Paper Billing Forms

Providers can also submit paper-based claims. Paper-based claims have 4 different standards, including CMS-1500, CMS-1450, NCPDP, or an ADA claim form. These must be typed or printed to avoid rejection, with specifics in Appendix A of the Medical Billing and Payment Guide. Each standard has its own purpose and requirements, discussed below:

| Form Name | Purpose | Usage | Usage Key Requirements | Version/Details |

| CMS-1500 | Physician, pathology, DMEPOS, ambulance billing | Physicians, related providers | Typed entries, UBC/ICD codes, per Appendix A | Version 02-12, post-April 2014 |

| UB-04 (CMS-1450) | Inpatient/outpatient hospital, rehab, and surgical centers | Institutional providers | Typed, UBC/ICD codes, per Appendix A | Aligned with OMFS |

| NCPDP WC/PC Claim Form | Pharmacy services | Pharmacies | Typed, include 402-D2, UBC/ICD codes | NCPDP standard |

| ADA Dental Claim Form | Dental services | Dentists | Typed, UBC/ICD codes, per Appendix A | Focuses on oral services |

Paper submissions must adhere to OMFS codes to qualify as complete, with handwritten forms risking immediate denial.

ii. Electronic Billing Standards:

Medical bills can also be submitted electronically. As per the DWC report, electronic submissions help streamline processing, which reduces timelines by up to 40%. California is one of the three states in the USA to adopt electronic bling first. The DWC mentions using ASC X12N transaction sets for most claims and NCPDP for pharmacy billing, with specific formats detailed in the guide:

• Professional Claims:

ASC X12N/005010X222A1 is used for Health Care Claim. Professional (837), using loops like 2010BB for payer identification and 2000B with Claim Filing Indicator ‘WC’.

• Institutional Claims:

ASC X12N/005010X223A2 is used for coding for hospitals and facilities.

• Dental Claims:

ASC X12N/005010X224A2 is used for oral services.

• Pharmacy Claims:

NCPDP Telecommunication Standard D.0, including details like Compound Code ‘2’ (Field 406-D6) for mixtures and Prescription/Service Reference Number (402-D2) for invoice identification.

Electronic bills require precise coding, such as the Property and Casualty Claim Number in Loop 2010CA REF02, to link to the injury. Acknowledgments like ASC X12C/005010X231A1 (999) validate syntax, while ASC X12N/005010X214 (277) checks content, ensuring compliance within hours.

Managing Resubmissions, Appeals, and Workers’ Compensation Collections:

Resubmissions and Duplicates:

Correcting or resubmitting bills requires precise coding. For corrections, use Claim Frequency Type Code ‘7’ in Loop 2300 CLM05-3, referencing the original Payer Claim Control Number. Duplicate bills would wait 15 working days after acknowledgment and should follow payment; however, the bill would contain Condition Code W2 to Loop 2300 HI. To retain clarity, balance forward billing is not allowed.

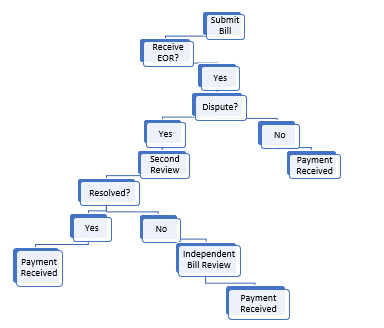

Appeals Process in workers’ compensation:

Appeals, or requests for second review, must occur within 90 days of EOR receipt, using codes like ‘W3’ for first-level disputes or ‘W4’ for post-jurisdictional decisions (§9792.5.4). If unresolved, independent bill review follows within 30 days, resolving 70% of disputes per DWC data.

This flowchart highlights critical deadlines to optimize workers’ compensation collections.

Figure 2workers’ compensation appeal process

Payment and Remittance:

Payments issue via ASC X12N/005010X221A1 (835), detailing adjustments with Claim Adjustment Reason Codes (CARC) like 191 (linked to Labor Code §3600 for liability denials) and Remittance Advice Remark Codes (RARC). Administrators must pay or object within 45 days under Labor Code §4603.2, with electronic funds transfer (EFT) cutting processing times by 50% compared to checks. Providers can seek help from trusted hearing representatives to track these, ensuring compliance.

WC Collections Services in CA: Timelines and Best Practices:

Navigating WC collections services in CA demands adherence to strict timelines. Documentation, supported by ASC X12N/005010X210 (275), requires PWK segment annotations (e.g., ‘OB’ for operative notes). Key practices include:

1. Verify claim numbers early to avoid holds.

2. Use DWC’s online billing form index for templates.

3. Appoint reliable service providers for complex submissions.

4. Monitor acknowledgments (TA1, 999, 277) to track delays.

Providers must retain records for six years per §164.316, periodically reviewing policies to stay compliant.

Security, Confidentiality, and System Updates:

Appendix C mandates robust security measures, mirroring HIPAA but adapted for workers’ compensation. These include administrative safeguards (e.g., workforce training), physical controls (e.g., facility access limits), and technical safeguards (e.g., encryption, unique user IDs). Violations trigger sanctions, ensuring medical information integrity.

Wrapping it up!

The California workers’ compensation billing and collection guidelines are a rather complicated system. With the help of mastering the formats, roles, and timelines, providers can maximize reimbursements and maintain standards of care. Utilization of DWC resources and accurate coding, as highlighted in the companion guide, is the key to making this process efficient and less prone to disputes, which is of value to all of the stakeholders in this essential healthcare system.